If I tell you diversity is key to becoming a winner for an individual and a society, you may raise your eyebrows in doubt. Have you heard of these big companies such as BlackRock, Vanguard, Fidelity and State Street? They’re asset managers that manage several trillion dollars of assets with clients that you may be more familiar such as JP Morgan, United Airlines, Verizon and Google. These asset managers are rarely discussed outside the specialized financial press. But the success of their investments results in the fact that “they are diversified and many of their investments are held somewhat passively,” according to Radical Markets (2018), a book by Eric Posner and Glen Weyl about how to radically expand the scope of markets to reduce inequality while promoting economic growth.

Unlike a public company which buys and sells stocks, the institutional investors mostly hold onto their stocks. This is what “passively” means in Radical Markets. Diversification reduces an investor’s overall level of volatility and potential risk. You may have heard of the old saying, “Don’t put all your eggs in one basket.” Your personal investment advisor may also have introduced you to a diversified 401k retirement portfolio. The idea is about the same as what the asset managers do for American Inc. If your stocks perform awful on Wall Street, your foreign investments may offset losses. Because of diversification and passivity, the institutional investors are super successful and wealthy. When combined, BlackRock, Vanguard, and State Street constitute the single largest shareholder of at least 40% of all public companies in the United States and nearly 90% of public companies in the S&P 500 (Posner and Weyl, 2018). Can I infer that the super rich already understand the value of diversity at least in the sense of investment and make a successful life out of it?

In the spectrum of a diverse workplace, a company or an industry thrives on innovation and efficiency contributed by employees from different cultural and ethnic backgrounds. Silicon Valley and the Hollywood are two renowned locations in the world for attracting foreign talents. A glimpse of the major immigration waves in the U.S. during the colonial era and two world wars in the 20th century tells me a lot. How many first generation immigrants and their foreign-born descendants have made great achievements and received accolades such as Nobel Prizes, Olympics medals and alike representing the United States of America? As a global sustainability writer, I feel strongly that diversity sparks new ideas and constantly surprises me with our shared values and different identities. Diversity complicates solutions to sustainability challenges but also enriches the variety of mechanisms to respond to the non-linear sustainability challenges such as climate crisis and water pollution and scarcity. Do you know the California wildfires not only destroy homes, trees and power lines but also contaminate public water supplies? In communities devastated by fires, extremely high levels of toxic chemicals like benzene are found in tap water.

As many countries are scaling up solar power projects, one of the biggest challenges is to store renewable energy especially when the sun doesn’t always shine and the wind doesn’t always blow. How to keep the power grid stable and resilient when we are only in the beginning phase of energy transformation from fossil fuels to clean energy? I am up for a diverse energy mix to integrate wind, solar, biogas and other renewable sources into the energy grid. The next generation of nuclear reactors could also produce carbon-neutral energy more safely and efficiently. China is already on track to outpace the U.S. in applying the new generation nuclear power technology to its power grid as early as 2030. Another energy source can be from the landfills. This is an example of circular economy as a typical landfill lasts 30-50 years. So this represents a legacy resource which produces biogas for quite some time. Landfill gas-to-energy projects involve capturing methane, a byproduct of the municipal solid waste including food waste. Methane is the largest component of natural gas, and natural gas leaks are predominantly methane. Carbon dioxide and methane are both critical greenhouse gases. In fact, scientists have found that as one of the highly potent short-lived climate pollutants (SLCPs), methane heats up the climate over 80 times more, averaged over 20 years, than an equivalent amount of carbon dioxide. Racing with time to meet the Paris climate agreement goals, we’ll need to have a diverse energy mix to ensure energy security. It is imperative to capture methane which stays aloft for years alongside curbing carbon dioxide which stays in the atmosphere for decades or centuries.

Scaling up renewable energy and climate resilience require funding and investment. Traditional finance focuses on financial return but sustainable finance considers financial, social and environmental returns in combination. When we see the rapid development of solar and wind power in China, it is not hard to think of the nascent industry with strong government backing. China’s green bond market expanded rapidly from 2016-2019, growing to the second largest green bond market globally. China is also exploring cross-border payments for digital currencies, a move to promote the use of yuan in global payments and weaken the U.S. dollar’s position as the world’s dominant reserve currency. On a global scale, fundraising is no longer limited to traditional financial institution. Blockchain technology enables cryptocurrency such as Bitcoin and Ethereum to finance projects of all sizes and across boundaries. Last month Tesla invested $1.5 billion in Bitcoin to diversify its investments, prompting a crypto price mania. In the development finance space, accelerating photovoltaic solar projects in developing countries may be considered blended finance. As the name suggests, blended finance combines several different sources of capital. It’s the use of public and philanthropic capital to catalyze private investment in developing countries around key development priorities. It’s still in its early stage of standardization and implementation but its financial inclusion attracts more diverse pools of capital from commercial investors. Diversity is wealth for finance.

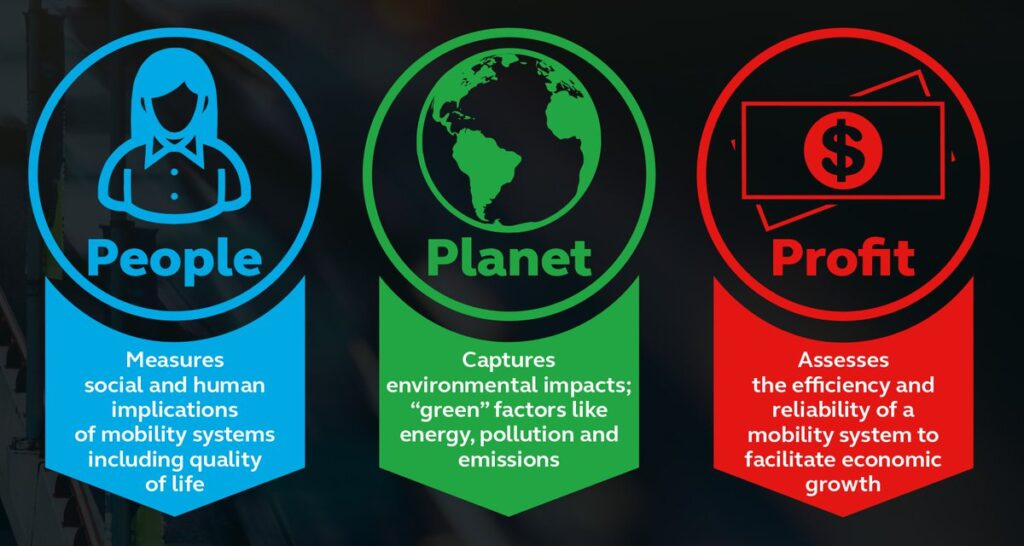

The diversity of life makes up the Earth’s biosphere, thus we call the variety of life on Earth at all its levels “biological diversity,” namely biodiversity. Biodiversity supports everything in nature that we need to survive—food, clean water, medicine, and shelter. But due to a rapidly expanding human population, exploitation, habitat destruction and climate change, biodiversity decline continues worldwide. In light of the COVID-19 pandemic, last year’s postponed United Nations Biodiversity Conference will be held in Kunming, China on May 17 this year. It’s worthwhile to participate in the efforts to rescue biodiversity which is the most vulnerable pillar among the three pillars of sustainability—economy, society and the environment. The health of biodiversity is the wealth of the environment.

As Rachel Carson once said, “Only within the moment of time represented by the present century has one species—man—acquired significant power to alter the nature of the world.” Her wisdom remains timely today in the 21st century. Only man can create and safeguard a sustainable world with diversity and inclusion for oneself, one’s community and one’s environment. Diversity increases the wealth for one’s mind and livelihood.

“Problems worthy of attacks, prove their worth by hitting back.”

—Adam Smith